Soluciones en moneda complementaria para tu comunidad

Vivimos momentos en los que hay que volver a los valores que nos permiten avanzar como sociedad. En Ubiquat creemos en la gente y en los gobiernos comprometidos. Y por eso hemos creado vCity, la primera plataforma de moneda local basada en dinero electrónico que impulsa valores sociales, económicos y medioambientales.

Con vCity tu ciudad mejorará en distintos aspectos:

Democratización y mejora de los servicios

Soporte a la economía y comercio local

Reducción del impacto medioambiental

Lucha contra las desigualdades y exclusión social

Descubre lo que una moneda social puede hacer en tu comunidad

Ámbito social

Promover hábitos saludables en la comunidad como deporte, vida asociativa y diversidad cultural.

- Social

- Econòmico

- Medioambiental

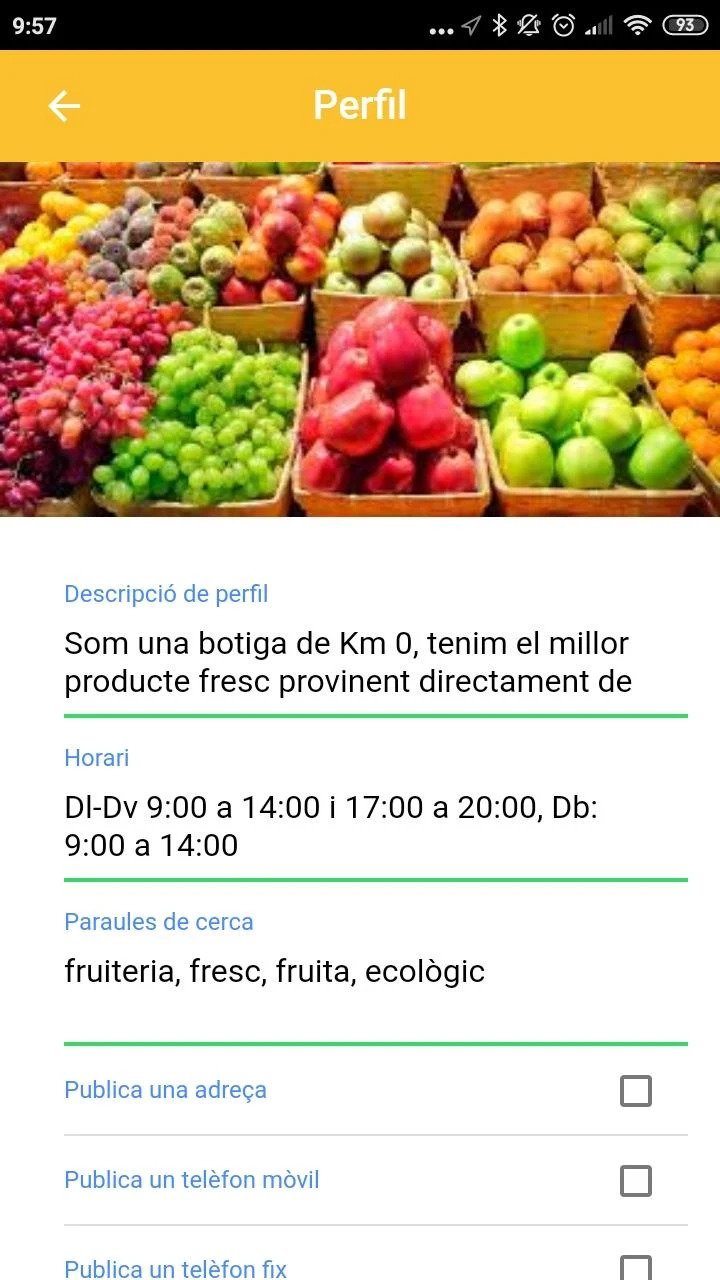

Ámbito económico

Favorecer el desarrollo del comercio local de proximidad y del autoempleo y la optimización de los recursos locales.

- Social

- Econòmico

- Medioambiental

Ámbito medioambiental

Incentivar el comportamiento proambiental con programas de reciclaje, uso de transporte público o el consumo responsable.

- Social

- Econòmico

- Medioambiental

Involucra la ciudadania

Te ayudamos a implantar soluciones para involucrar, recompensar, y mesurar la promoción y consecución de los objetivos estratégicos de tu comunidad, ciudad, barrio o asociación mediante la emisión, implantación y gestión de moneda local complementaria.

Plataforma vCity, nuestra solución global

Segura

Nuestra experiencia de más de 10 años desarrollando sistemas de pagos avanzados nos avalan.

Legal

Todos proyectos pasan un control jurídico de nuestro equipo legal, ofreciendo total tranquilidad a los usuarios.

Social

Estimular hábitos saludables en la comunidad como el deporte, la vida asociativa y la diversidad cultural.

Operativa

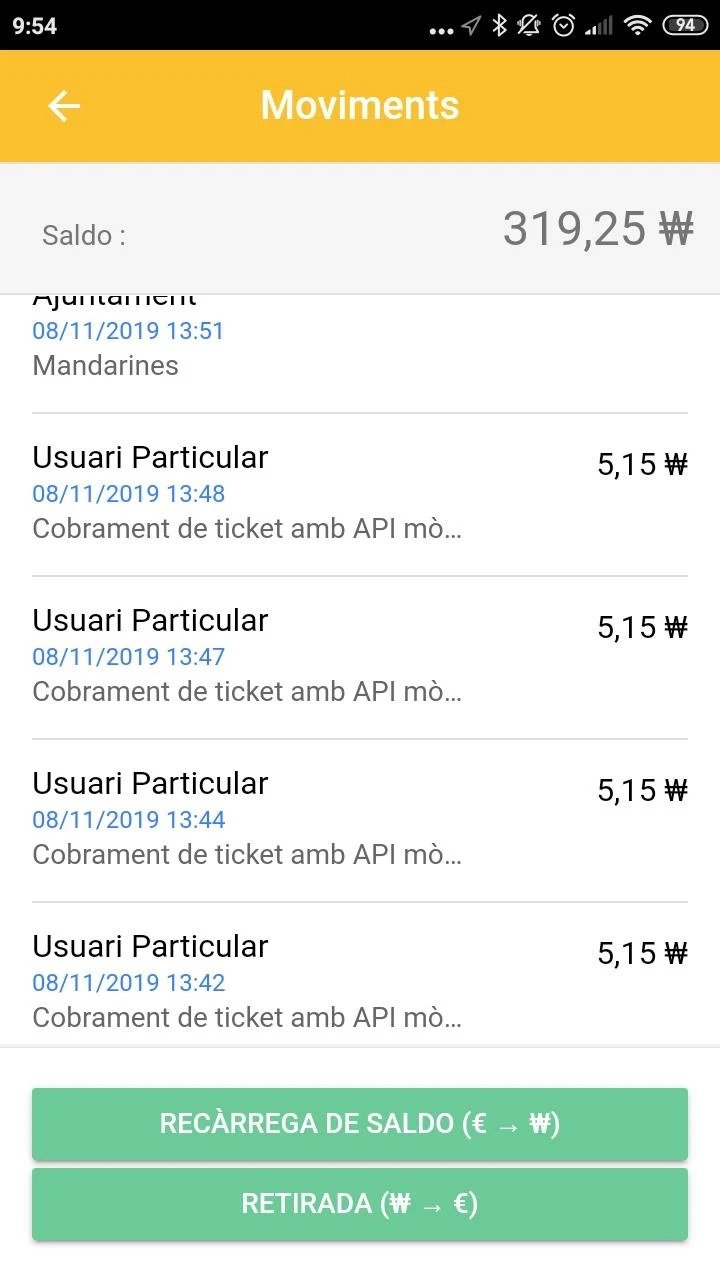

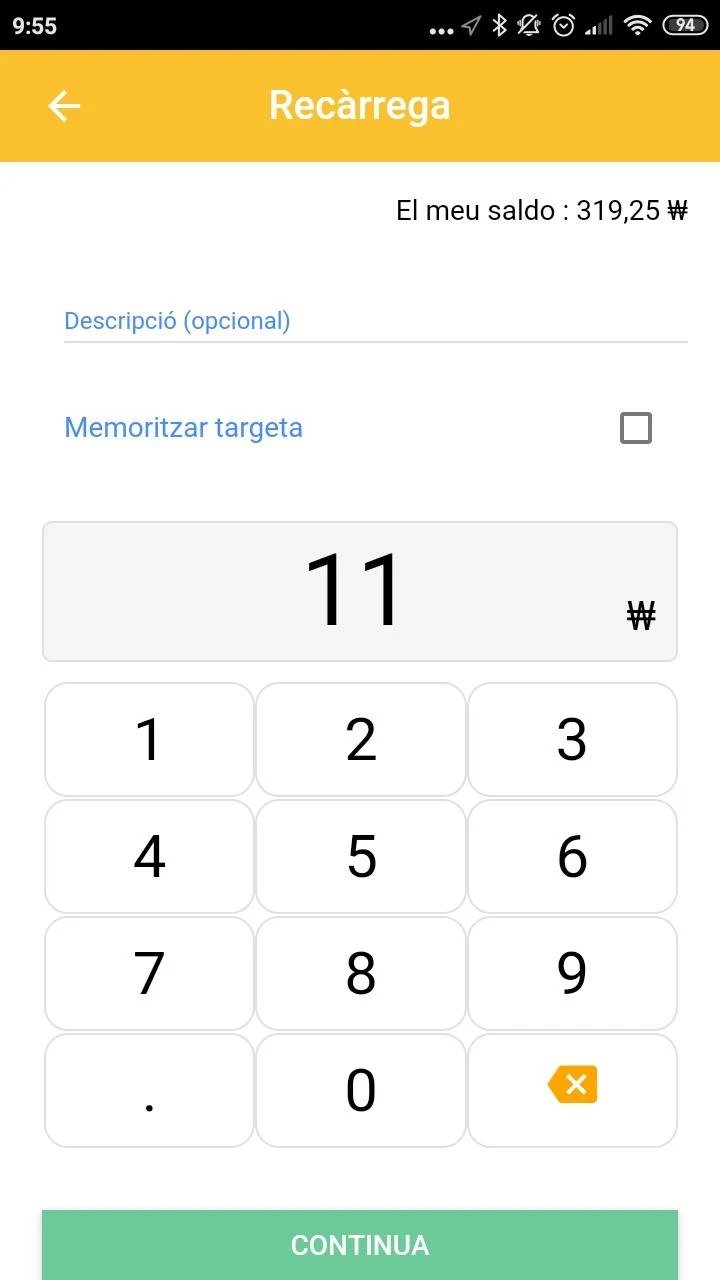

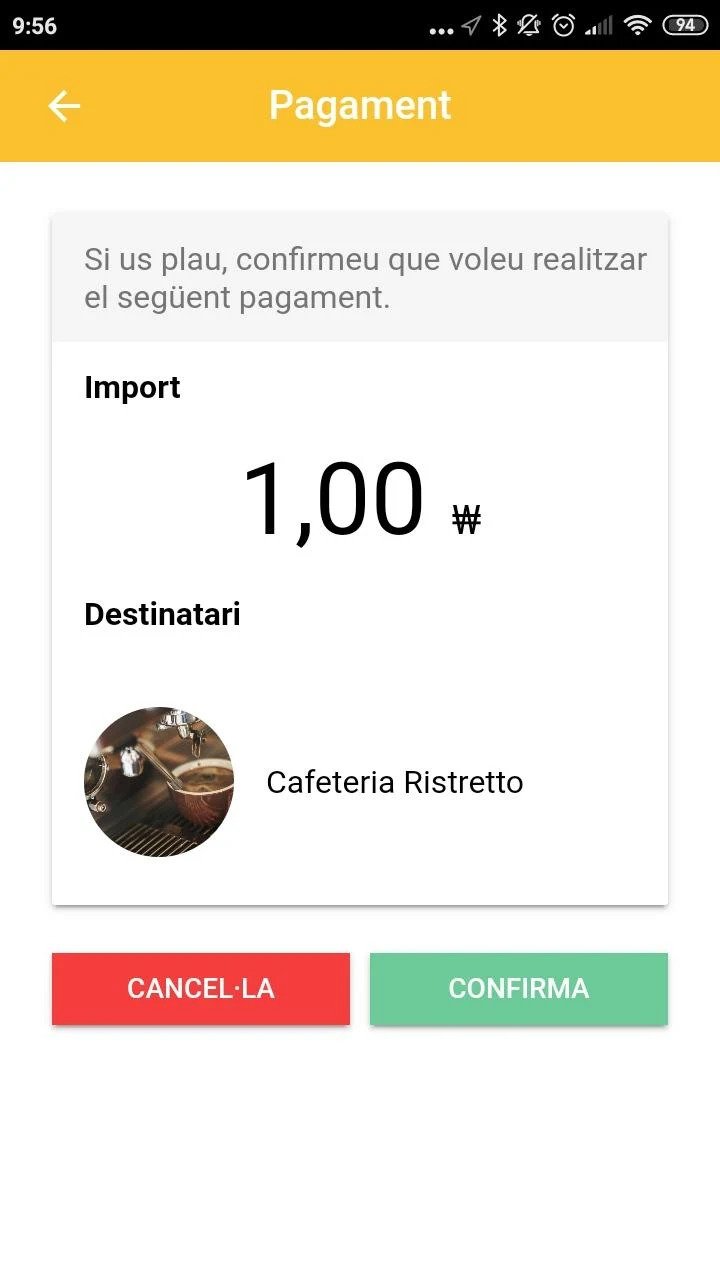

Enlace con dinero electrónico, pago por whatsapp, TPV virtual para comercio electrónico, control inteligente de ayudas públicas, y mucho más!

Proyectos

Mira cómo nuestros clientes han confiado en Ubiquat para implementar soluciones innovadoras de moneda complementaria, sistemas de pago y tecnologia para reactivar sus comunidades.

Empieza por aquí

Explícanos algo sobre tu comunidad y te contactaremos para darte soluciones.

O llámanos al 938 036 914